Overcapacity of the Steel Industry Has been a Time Bomb

Despite China signaling moves to cut its excess steel production capacity, industry chiefs say the country has declared a metals "war" that has had a "devastating" impact for the rest of the world's industry.

Overcapacity of the steel industry has been a time bomb in the side of the sector in recent years, pushing prices down and making it harder for some steel companies to survive.

China's low-cost metal producers have been widely cited as the main culprit for the glut. In particular, the world's second largest economy has been accused of "dumping" cheap steel to the global markets to gain market share, for a slowdown in domestic demand. However Beijing has denied any wrongdoing and has said that its costs are lower than other producers.

It's war, not trade

Other countries, including India, Italy, South Korea and Taiwan, have also been cited as contributing to the global steel glut. Export said that each country had its own set of subsidies and problems that "create the massive problem of dumping steel in the international market."

Similarly to the oil industry, however, despite a slump in demand, some producers have been slow to cut production in a bid to support prices and in 2015.

In addition, it said that non-OECD economies (such as China) are expected to lead the capacity expansion in the global steel industry, with their share of world capacity expected to increase to 71.4 percent by 2017.

There aren't signs that global steel production is slowing in the immediate term.

While world crude steel production was 385.7 million tons (Mt) in the first three months of 2016, down 3.6 percent compared to the same period in 2015, according to the World Steel Association, China's crude steel production for March 2016 was 70.7 Mt, an increase of 2.9 percent compared to March 2015. India's crude steel production was 8.1 Mt in March 2016, up by 3.4 percent on March 2015.

"Just based on the numbers, China is by far the largest problem," exports said, accusing China of not abiding by the rules of international trade. "You can't call yourself competitive if your competitiveness is based on cheating the international rules of trade. Trade without fairness is not trade, it's war."

Overcapacity of the steel industry has been a time bomb in the side of the sector in recent years, pushing prices down and making it harder for some steel companies to survive.

China's low-cost metal producers have been widely cited as the main culprit for the glut. In particular, the world's second largest economy has been accused of "dumping" cheap steel to the global markets to gain market share, for a slowdown in domestic demand. However Beijing has denied any wrongdoing and has said that its costs are lower than other producers.

It's war, not trade

Other countries, including India, Italy, South Korea and Taiwan, have also been cited as contributing to the global steel glut. Export said that each country had its own set of subsidies and problems that "create the massive problem of dumping steel in the international market."

Similarly to the oil industry, however, despite a slump in demand, some producers have been slow to cut production in a bid to support prices and in 2015.

In addition, it said that non-OECD economies (such as China) are expected to lead the capacity expansion in the global steel industry, with their share of world capacity expected to increase to 71.4 percent by 2017.

There aren't signs that global steel production is slowing in the immediate term.

While world crude steel production was 385.7 million tons (Mt) in the first three months of 2016, down 3.6 percent compared to the same period in 2015, according to the World Steel Association, China's crude steel production for March 2016 was 70.7 Mt, an increase of 2.9 percent compared to March 2015. India's crude steel production was 8.1 Mt in March 2016, up by 3.4 percent on March 2015.

"Just based on the numbers, China is by far the largest problem," exports said, accusing China of not abiding by the rules of international trade. "You can't call yourself competitive if your competitiveness is based on cheating the international rules of trade. Trade without fairness is not trade, it's war."

A worker polishes steel coils at a factory of Dongbei Special Steel Group in Dalian, China.

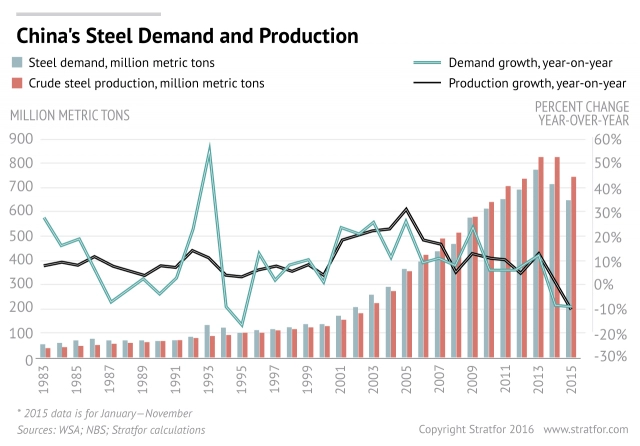

china-steel-demand-and-Production